This blog is part of the blog series “How to start your personal finances from 0”

1- The basics

3- Select your first credit card

How to build credit

Credit reports are like a permanent record of your borrowing history and credit scores are a sort of report card which show how well you have been behaving when it comes to borrowing. They were created as a tool for banks and other lenders to gauge a borrower and check their past records before they could lend to a new customer. Before we take a deep dive into how to build credit or improve your score, it would serve us well to look at what a credit report is actually made of and what affects your score.

What affects my credit score?

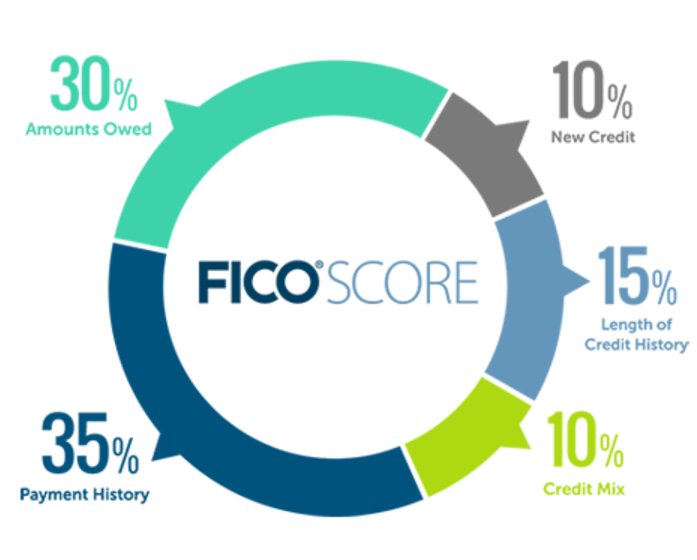

There are a few different types of scores with the most popular being FICO and VantageScore. There are various factors which go in as inputs and the output is your actual credit score. Here’s a breakdown of what makes up your FICO score.

Image Source: http://www.myfico.com/

As you can see, the most important factor here is your payment history which is based on how prompt you are in paying your loans or instalments. Any delays in payments affect your score significantly.

The second most important factor is the total quantum of loans outstanding – not in absolute terms but rather in percentage terms. So for example, if you have a $2000 credit card and you utilize 70% of your limit all the time, it is a sign that you are overextended financially and this will lower your score.

These two factors make up the bulk of your score. One more factor is the length of your credit history – if you have been paying your debts regularly for 5 years, you would have a higher score than if you have only been a borrower for just 1 year. Credit mix is also considered – so having a healthy balance of credit cards, instalment loans, mortgage loans is better than having only, say, 5 credit cards. The final factor is new credit – how actively you have been seeking new loans. If you have 5 new loan accounts open all of a sudden, it is a sign that there is some financial stress and your score might dip slightly.

These factors are what determine your credit score. Keep in mind that your salary, location, age etc. will have no bearing whatsoever on your credit score. However, banks still look at these separately, in addition to your credit score, in order to determine your eligibility for a loan.

What does building credit really mean?

If you have never borrowed before from a bank or financial institutions (credit cards are a form of borrowing by the way), then you have no credit history. Unfortunately, having no credit history might also cause some banks to reject your loan or credit card applications. What they really want is a good credit history. But you might ask, how can I build a credit history if I can’t get a loan in the first place? There are some ways to get around this and we will discuss them in the next section. For now, let’s focus on what building credit really means.

Once you have successfully borrowed a loan, the lender will send details of your payment history periodically to a company like Experian, TransUnion or Equifax. These companies specialize in accepting all the information from various banks and financial institutions and collating it in order to make your credit report and assign a credit score. If you haven’t done so already, you should get a free credit report from AnnualCreditReport.com right now – you can do this for free every 12 months (getting it more frequently costs a certain amount).

If you spot any mistakes or errors on your credit report, contact the bank that sent the information or contact one of the above mentioned credit agencies. For further assistance, you can have a look at the detailed guidance provided by the federal government at this site.

What is a good credit score?

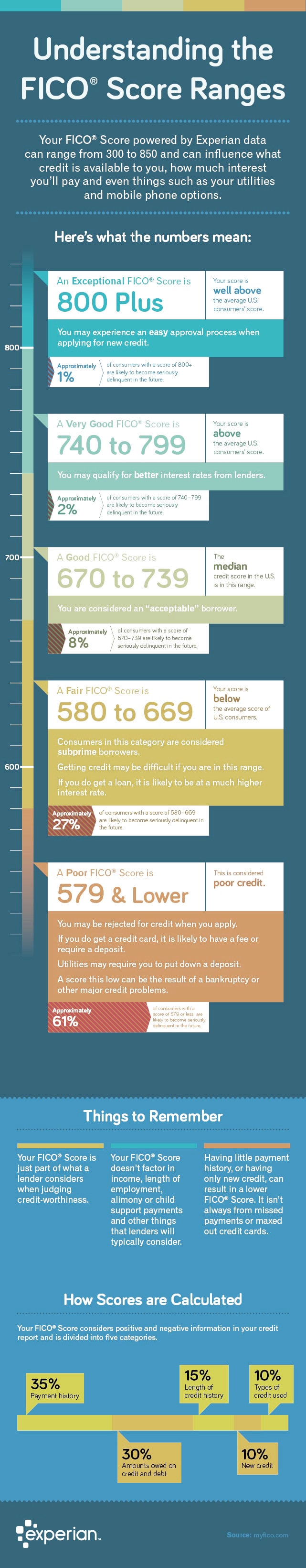

To be fair, there is not an exact set number which determines a good or bad score. Banks take into account a number of factors when making a lending decisions and your credit score is just one component of it. For example, even if you have just an average score, but have a good and stable job, you might still get a loan easily. Similarly, having a stellar credit score will not grant you a loan that far exceeds your paying capacity. Here is a helpful infographic by Experian explaining the broad ranges of credit scores and what they mean. Use this as a broad guideline, rather than something which is set in concrete.

Image Source: http://www.experian.com/

Keep in mind that these are just general guidelines from Experian. Banks and credit card companies might have their own internal guidelines which might differ a bit but will still be close to these numbers. Also remember to check you score at least once every year and if you find any mistakes, make sure you resolve them immediately by using the guide in the previous section.

How can I build good credit or improve my score?

Get a credit card and be a good customer

The easiest way to build a good credit score it to apply for a normal credit card and use it appropriately. It is not enough just to pay your balance on time, you also need to make sure that your outstanding balance is not too high compared to your assigned limit. So for example, if your credit limit is $2000 and you keep reaching $1500 or more every month and then paying it back, it would still damage your credit score. Lenders do not want you to be close to your credit limit all the time. It’s alright if this happens once or twice but not more than that.

Paying your balance on time is the main condition though. Even if you delay the minimum amount due by a single day, it will show up on your credit history and it will bring down your score a bit. Do this too often, and your score could be seriously damaged. However, if you keep paying on time and do not get too close to your credit limit, your score will keep improving with time. In a few years, you can get a stellar score!

Get a secured credit card

You might not always be able to get a normal credit card. If you have a good, stable job then you might get one but otherwise it might prove to be difficult (this is assuming you have no prior credit history). If you are in such a situation, you can opt for a secured credit card. A secured card is backed by some form of collateral – usually a cash deposit. So you can deposit $500, and get a $500 credit card. From there the process is similar to a normal credit card. By paying on time and staying well below your credit limit, you will build a good credit history over time. Eventually, you should be able to get a normal credit card.

Get a joint account credit card

You can get yourself added as an authorized user or a joint account holder with someone else who already has a credit card. This is a great way for parents to bring their children into the credit system who would otherwise not be eligible for a card. Over time, your credit history will improve as well.

Pay any student loans on time

If you have any student loans, then these are likely going to be the first things on your credit report. Pay them on time and your credit record will show it.

Get a secured loan

There are a number of other secured loan types that are easier to get and can help you build your credit score. A secured loan is one which is backed by some form of collateral. A perfect example would be an auto loan – which is secured by the actual vehicle itself. Since the auto loan is backed by the value of the automobile, it is easier to get when compared to an unsecured loan. If you need a car, then this is perfect way to kill two birds with one stone!

Other types of secured loan are ones that you can take against the balance on your bank account or against a certificate of deposit. These work like secured credit cards in the sense that you deposit some money and then borrow against it – mostly just to build your credit history.

Credit Unions and other special organizations

Credit Unions are generally a bit more customer friendly than traditional banks or credit card companies. They usually serve a smaller, localized area and are therefore more connected to the communities they serve. You can contact your local credit union and get a credit product from there, like this one in North Carolina or this one if you are in Florida, California or Illinois.

In addition, certain organizations help consumers build credit with low interest bearing small loans. MAF is one example and Credit Sesame can help you find more.

Using your rent payments to build credit

Since 2011, it has been possible to use your rent payments to build your credit. Unlike all other credit products, this is not automatic, and you have to voluntarily opt in. Keep in mind, however, that it works both ways and once you join, any delayed rent payment will start to affect your credit score adversely. Here are some websites that you can register on for this: Rental Kharma, Rent Track.

Conclusion

Your credit scores are affected by your payment history of the last 7 to 10 years. They affect all your borrowings and these days even employers are checking the credit reports of their potential or existing employees! Therefore, it is important to keep on top of everything that can potentially affect your credit report. Make sure you pay all your loans on time, do not take on too many loans and stay well below your maximum credit limit – if you do this, you will build a stellar credit in no time!