How to fill out the FAFSA to get the best financial aid package

What is FAFSA?

The Free Application for Federal Student Aid (FAFSA) is a form used to determine eligibility for student aid. This applies to current and prospective students. While the FAFSA is designed to assess eligibility for federal aid, it is also used by states and schools to assess eligibility for non-federal aid.

The form is available on the FAFSA website, and comprehensive information is also available on the Federal Student Aid website. In this article, we will give you an overview of what you need to know about applying for aid and how to apply.

The most important points to remember

Get started soon and apply online. You can save the form and come back to it if you need to find out information.

If you initially think you aren’t eligible, do some more research. Even if you aren’t eligible for standard aid, you may be eligible for some other form of aid. If you are unsure, apply anyway – it costs nothing to apply, and you never know what you may get.

Make sure you apply on the FAFSA website and not on a third-party website. These sites may charge you to fill it out, while the official site is free.

Who is eligible?

The general requirements are that applicants must demonstrate financial need, be a US citizen or an eligible noncitizen, have a valid social security number and be registered with a selective service (if male).

You will also need to be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program.

Also, you will need to:

- Be enrolled at least half-time to be eligible for Direct Loan Program funds.

- Make progress in college.

- Sign a statement declaring that you are not in default on a federal student loan and that you will only use the aid for educational purposes.

- Have a high school diploma, GED certificate, home-schooling completion credential, or enroll in an eligible career pathway program.

Types of aid

The aid you are offered may consist of a combination of grants, scholarships, loans and work-study programs.

Grants and scholarships don’t need to be repaid. Grants are usually based on needs, while scholarships are based on merit. They can both come from the federal government, state, school or from nonprofit organizations. That means that depending on where you apply, there will be different grants and scholarships available.

Loans must be paid back, but vary greatly. The loans you will be offered after you fill out the FAFSA are federal loans. You can also take out a private student loan from a financial institution. You should try to borrow what you need with a federal loan before taking out a private student loan. Federal student loans offer a whole lot of advantages.

Work study programs are administered by schools to help students with financial need earn money while studying. Most jobs are part time and on or close to campus. On-campus jobs will mean you’ll be working for the school, while off-campus jobs will usually be with public agencies or non-profit organizations. Most jobs will be related to the course you are studying.

How to apply

You can apply online or by mail. Online applications are far easier because the system will ask you to fill in only the information it needs. If you fill out the paper version, you will have to figure out the relevant sections yourself, and you may miss important information.

Deadlines

- You should apply as soon as possible and every year. You can submit your application from October 1 every year.

- Aid is awarded on a first come first served basis – so apply as early as possible.

- Deadlines vary by state and school– so find out when you need to submit it by.

The information you need. The department of education provides an online worksheet to help you gather all the data. The list below will give you an idea of what you will need, but it’s a good idea to use the worksheet to make sure. Depending on your personal situation you may need some extra documents, but you will definitely need the following:

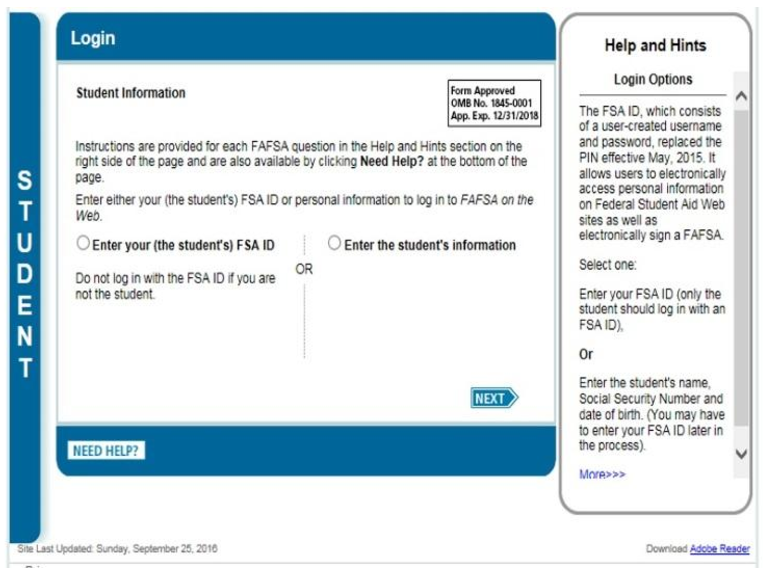

- Your FSA ID.

- Social Security number or card.

- Driver’s Licence (if you have one).

- Tax records for the previous two years, for you and your parents.

- Records of any other money earned, for you and your parents.

- Records of any untaxed income in the previous two years.

- Records of income from federal work study programs or other need-based work programs.

- Current bank statements

- Records of any investments you have. This does not include the home in which you live.

- Documentation to prove you are a US permanent resident or other eligible noncitizen if applicable.

Once you have a FSA ID you will not have to enter your basic details again.

Dependency

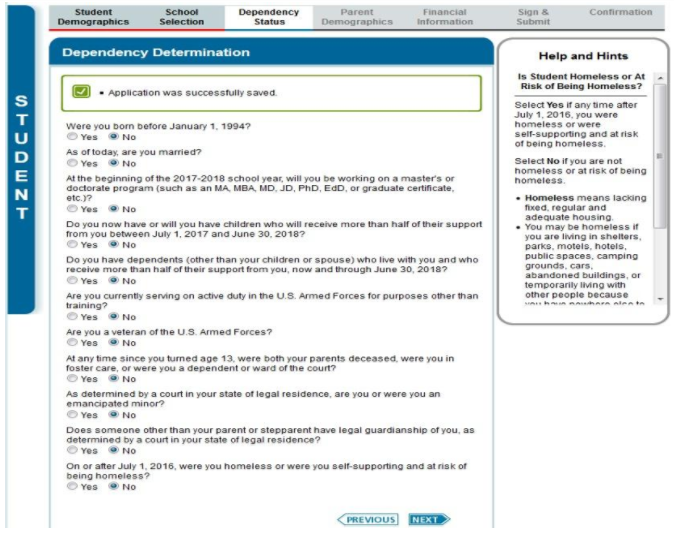

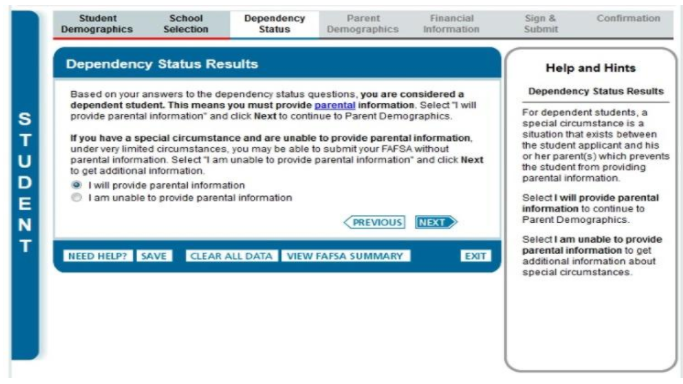

If you can demonstrate that you are an independent student, only your information needs to be entered, or if you are married, you and your spouse’s information needs to be entered.

The form will ask you questions to determine whether you are dependent or independent

If you are a dependent student, either one or both of your parents will have to enter their information. If your parents live together, they will both need to enter their details. If your parents are separated, then the parent you live with more of the time will need to enter their information.

If you are a dependent, the form will ask for your parents to enter their details too.

Creating an FSA ID and Password

Before you fill out the form, you will need to create an FSA ID and password. If your parents also need to fill out part of the form, they will each need to create a separate FSA ID.

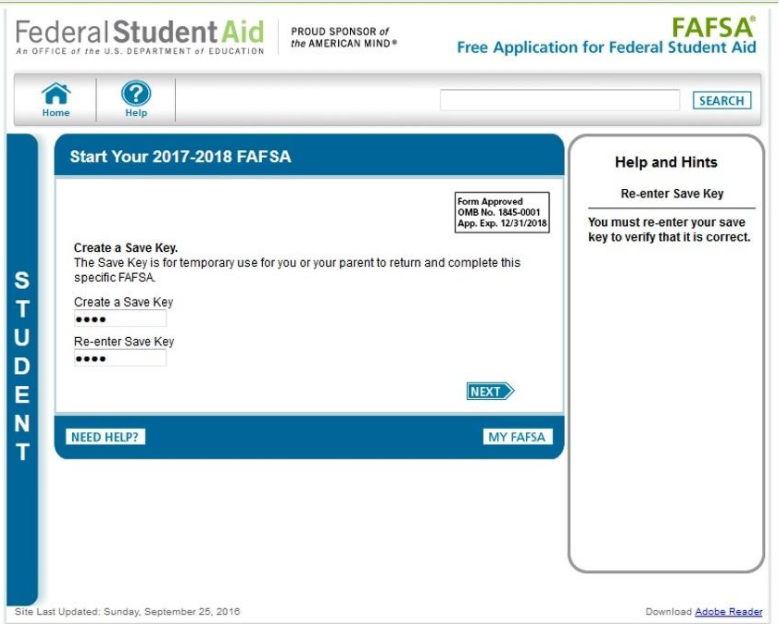

You can also create a Save Key, which is different from your FSA ID. A Save Key allows you and your parents to pass the form back and forth while completing it. This is very useful if you and your parents live in different locations.

The Save Key will enable you to return to the same form.

How to fill out the form

Take your time – mistakes may cause you to miss out. The system will cross check all the information you enter with other databases. If you enter information incorrectly, whether you do so deliberately or by mistake, your application is very likely to be rejected.

Most of the form is self-explanatory, but here are some helpful hints:

- Make sure your details match the details on your social security card. If there is a mismatch, your application will be rejected.

- You can save the form as you go along and come back to it later.

- If you are not sure of any of the information, don’t guess. Save the form, find out the required information and then go back to the form.

- Don’t use decimals or commas in the numeric fields. Just round all amounts to the nearest dollar.

- Use your permanent address, not your campus address.

- Click yes for work study – you never know what opportunities may come up.

- If you claim to be an independent student, you will need to provide proof.

- You can list up to ten schools if you fill in the form online, and four if you submit the paper version. The more schools you list, the more options you will have available to you.

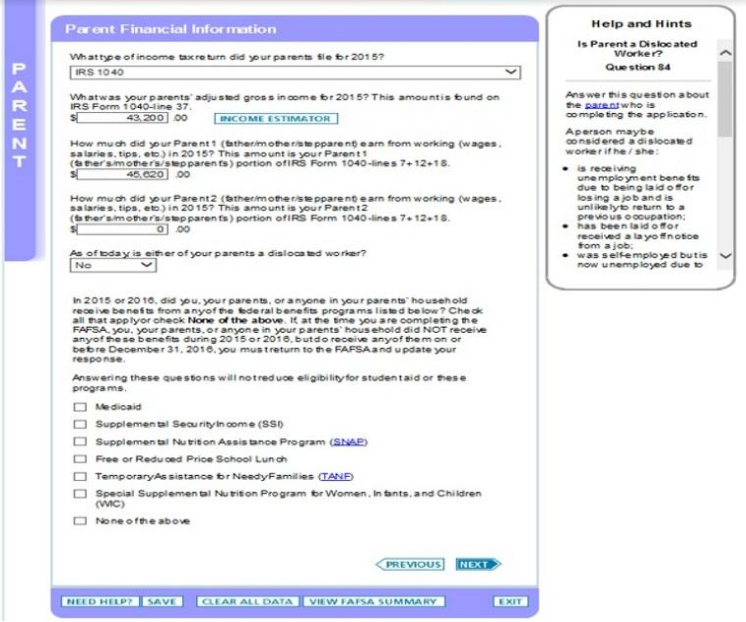

- If you claim to be a dependent student, you will need to provide financial details for you parents.

- The system will gather information from the social security and IRS databases, so if the data you enter is not correct, it will raise red flags.

- The new IRS data retrieval tool will populate your tax data automatically. But make sure you fill out any additional information.

The pages that need to be filled out by your parents include ‘PARENT’ on the left-hand side.

Submit the form

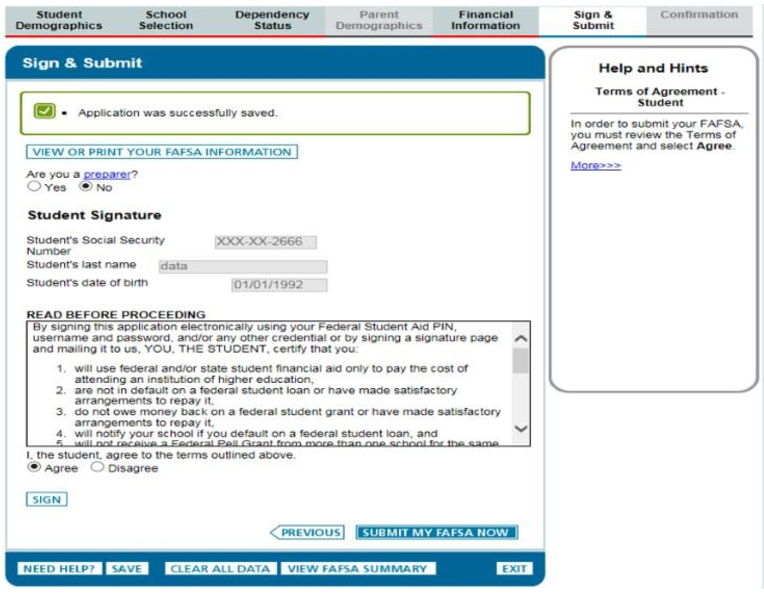

Once you have filled out all the required information and double and triple checked everything, you and your parents (if applicable) need to sign the form.

You can sign the online application by entering your FSA ID. But, make sure you and your parents enter your IDs in the correct place. It’s quite common for applicants to enter their IDs in the wrong place, in which case the form will be rejected.

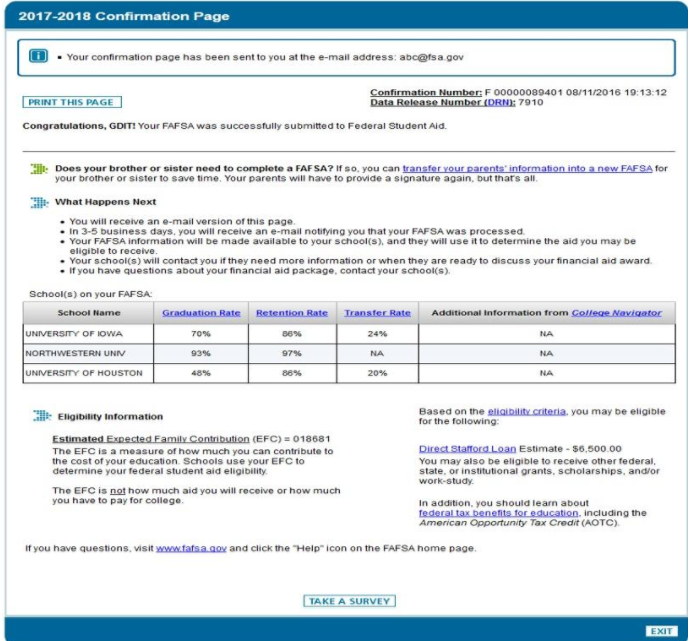

And, don’t forget to click ’Submit’!

To sign the form, enter your social security number and last name.

What happens next

- After a few days, you should receive an email to say your FAFSA was processed.

- The schools you list will automatically receive the FAFSA form. They won’t be able to see which other schools you applied to, but may see how much priority you gave to that school.

- The schools you’ve applied to may require you to validate some information or provide further information. Make sure you do so before any deadlines they give.

- After that, if you are a first-time applicant, you should receive an aid offer from each of the colleges you listed on your FAFSA. You can then review the aid you will receive for each college and decide which one suits your needs best.

- If you are a returning student, you will receive an aid offer from your school.

- To receive the aid, you need to formally accept the offer.

- Your school financial aid office will handle the aid. Ask them if any funds will come directly to you.

Make sure you see this confirmation screen after you submit the form

Tips

- Fill out the FAFSA every year. You can apply for aid for post grad courses too.

- Apply for multiple schools. That way you will have more options available to you.

- Follow up every three weeks. If something goes wrong, you may be able to rectify it in time.

- State funds are limited. The sooner and more accurately you fill out the form, the more likely you are to receive aid from state funds.

- There is no downside to applying. You won’t get aid if you don’t apply.

- When you receive an aid offer, you may also be offered a student loan. Only borrow the amount you actually need. You will have to pay this money back later, and if you cannot your credit score will be affected.

Resources

The following websites provide more details on specific aspects of the application:

- Student Aid Website

- This page will help you determine which of your parent’s details need to be on the form.

- A great source of information on aid available at the state level.

- This page explains how you should order the list of schools you apply for on the form.

- You can download a detailed powerpoint presentation explaining each page of the FAFSA here.

Conclusion

Education is probably the most important investment an individual can make. Filling out the FAFSA form does take a bit of time and effort, but it really isn’t that difficult and is well worth the effort. Personal student loans are very expensive and can have a significant effect on your creditworthiness in the future. Your first choice should always be a scholarship or grant, followed by a federal student loan, and only then should you look at personal student loans. And remember to fill out the FAFSA every year – it is not a one-off event, and you may be eligible for financial aid every year you study.