Saving for Education - An Introduction to 529 Plans

Student loans constitute a hefty chunk of the overall debt problem in the US. About 43 million Americans currently have outstanding student loans with the average outstanding balance hovering around $30,000. This number has only increased over the years and has now reached a point where it is begging to deter some prospective students from pursuing higher studies.

The Federal and various State Governments have all been working and coming up with plans to fix this problem. However, there are a few government supported initiatives already in place to help prospective students. One of these investment vehicles is called the 529 plan.

What is the 529 plan?

529 plans are tax advantaged investment vehicles that allow investors to save for future higher education needs for themselves or their families. Section 529 was added to the Internal Revenue Code in 1996 to allow students and families to start saving money for future education. This is where 529 plans, also known as qualified tuition plans, get their name from. They did exist in other forms and with other names, before in various states, but this marked their federal recognition.

529 plans allow parents or students themselves to start saving early and accumulate enough money to pay off college expenses without incurring significant (or any) debt. For example, if you start investing $200 per month into a plan returning 6% per annum when your child is born, you would have saved $76,000 by the time she turns 18. You can make such calculations yourself easily at this website.

All 50 US states have some sort of 529 plan active. These plans come in two varieties: prepaid tuition plans and college savings plan.

Prepaid Tuition Plans

These plans are mostly sponsored by state governments and allow residents to buy credits or units which can be used to pay for future tuition at various eligible colleges and universities. The advantage to saving under such a plan rather than in a normal account are the tax benefits as well as locking in the tuition fee at the time of enrolling in the plan and being protected against price increases.

College Savings Plan

These plans allow an investor (could be the student herself or anyone else sponsoring the student) to put money into an account to pay for the college expenses of the prospective student. The money thus saved is usually invested into different types of mutual funds and the account then accumulates some additional funds for the investor. These investments are not guaranteed by the government though (unlike the prepaid tuition plans), so investors should do their due diligence before choosing a reliable plan provider with a good track record.

The advantage of these plans is that they can be used for almost all education related expenses and can generally be used in any college or university (and not just in your home state).

Here is a brief comparison that may allow you to choose which type of plan is best suited for your specific needs:

| Prepaid Tuition Plan | College Savings Plan |

|---|---|

| Tuition fees may be locked in at the time of enrollment. | No “lock in” option. |

| Tuition fee and other mandatory fees are covered. Other expenses may or may not be covered based on your state and the plan. | All qualified higher education expenses are covered including tuition, room and board, books, computers, etc. |

| Most plans set lump sum and installment payments prior to purchase based on age and beneficiary and number of years of college tuition purchased. | Contribution limits vary from plan to plan. Some can exceed $250,000 – allowing students to cover almost any type of education. |

| Many state plans are backed by the state governments or even guaranteed. | There is no guarantee. The investment options you choose may lead to an increase in the value of your initial investment or even a decrease. |

| There are usually age limits in place. | No age limits. |

| These plans usually require the student or the investor to be a resident of the state where they plan to enroll. | No such requirement. |

| There is usually no investment option for you to choose from. | Plans provide various investment options like stock or bonds based mutual funds or even age based portfolios that adjust the risk based on how close the student is to college age. |

| Earnings grow tax-deferred and are tax-free if used for qualified education expenses. | Earnings grow tax-deferred and are tax-free if used for qualified education expenses. |

Information Source: Financial Industry Regulatory Authority

Keep in mind that any non-qualified withdrawals are treated as ordinary income and may be subject to an additional penalty of 10%.

What can you use the money for?

The proceeds from 529 plans may be used for “qualified” education expenses. Although you will find the exact specifics in the particular plan’s documentation, it will always cover any mandatory fees and the tuition fee. Other related expenses like books, room and board, laptops etc. might or might not be covered depending on the plan.

As already mentioned, withdrawing funds from a plan for a non-qualified expense will lead to a tax liability as well as a 10% penalty. In case the student decides to opt for a college or university which is not in her home state (and has purchased a prepaid tuition plan), the funds might still be transferrable to another state with some reduction in the amount. Most plans even allow the funds to be transferred to a family member (with age restrictions). You should check your chosen plan’s details regarding transfers before enrolling.

What are the benefits and the costs involved?

- The biggest benefit is the tax advantage.

- Federal Taxes - Any earnings on the 529 plans are tax deferred and as long as you withdraw the funds for qualified education expenses, it’s tax free. The tax-free limit for contributions to these plans is $14,000 a year. You can even make a bigger lump sum contribution of up to $70,000 by aggregating the limits for the next five years.

- State Taxes - The tax treatment differs from state to state and over US 30 states currently allow the contributions to be tax deductible if you are a resident of the state.

-

The other benefit of these plans is the flexibility. You can change the beneficiary to anyone in the family – if your child decides not to go to college, you can transfer the benefits to their sibling, first cousin, spouse, niece/ nephew, grandchild or even to yourself. These specifics vary between plans, though, so it’s a good idea to make sure before opting for one.

- A third benefit is that the control of the account is maintained by the investor/ donor and not the beneficiary. You can even withdraw the funds in most cases for your personal use (you will have to pay taxes and the 10% penalty though).

Although there are some costs/ risks involved, they are usually minimal.

-

Some of the expense that you may have to pay include: enrolment fee, annual maintenance fee, sales charge, fund expense etc. These are not usually that high and in some cases, may even be waived off (for example, annual fee may be waived off if you maintain more than, say $25,000).

-

College Savings Plans provide a return based on the market performance of their linked mutual funds. Therefore, it is possible that they may actually decrease in value. Be sure to check its track record or opt for the safest mutual funds.

-

It is also worth mentioning that the money you save in these 529 plans may be counted against parental wealth while calculating the child’s eligibility for financial aid. These differ from state to state but keep in mind that aid eligibility can change based on this and be aware of your local state laws before proceeding.

-

The only other disadvantage to these plans is that if the money is withdrawn for a non-qualifying purpose, then you not only have to pay taxes on any earnings made in the account, but an additional 10% penalty. This penalty may be waived off if the students gets a scholarship or is unable to attend the program due to some disability.

When should you start saving?

As with any saving plan, it is best to start saving as early as possible. However, it is never too late to start making an investment if you are in a position to do so. We already linked a great calculator which gives you an idea of how much you need to spend and how much you can expect to save.

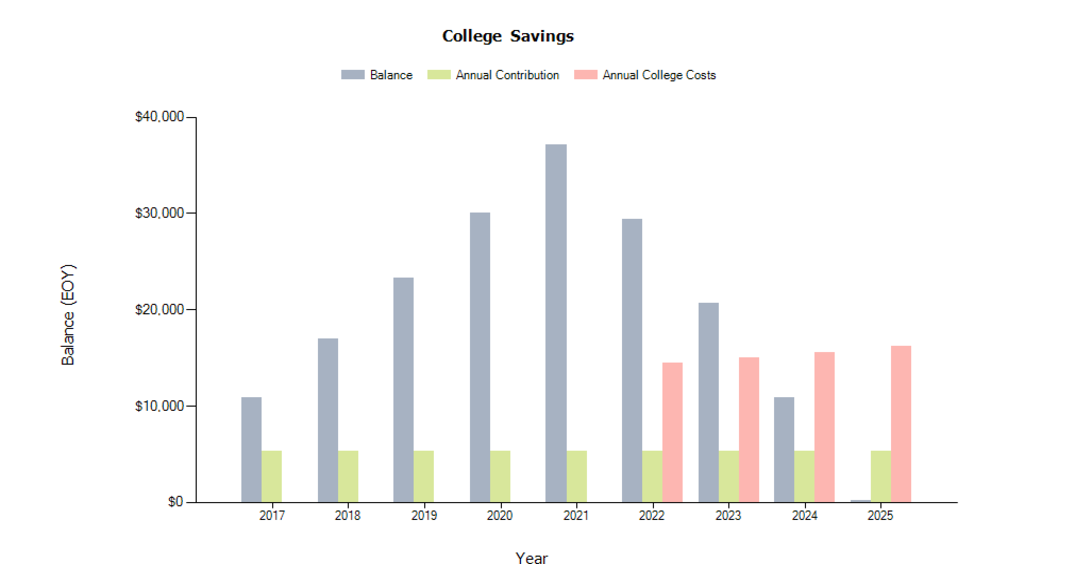

Image Source: FINRA Website

In the above chart, you can see just one of the many scenarios that you can test. For this case, we tested a total fee of $48,000 for a 4 year course. With a 5% annual return, and 5 years to save, the annual saving requirement comes to around $5,200.

Conclusion

A comprehensive education is the best way to safeguard yourself and your family against the ever-changing dynamics of the job market. As the importance of higher education has increased over time, so have the costs associated with it. Although many students (7 in 10) still opt for loans to help them get through college, it can turn into a burden in later years.

529 plans offer a great way to save in advance for the educational needs of your family. Not only will you benefit from the tax advantages that these plans provide, but the money you save will also likely grow with time. Why should you pay interest on a student loan later when you can earn money by investing in a 529 plan?

Many plans can be availed directly, but there are some plans which are distributed by intermediaries and agents. Be careful of high pressure sales tactics and always ask a lot of questions – especially with regards to fees, interest rates and how they invest your money. Here is a list from Morningstar which analyzes and rates some of the listed plans into gold, silver, neutral or negative brackets. Keep in mind that while your state plan may offer additional tax breaks, you don’t have to stick with it if you don’t like it.