This blog is part of the blog series “How to start your personal finances from 0”

1- The basics

3- Select your first credit card

If you want to learn more about our learning paths, go here.

Checking Accounts 101

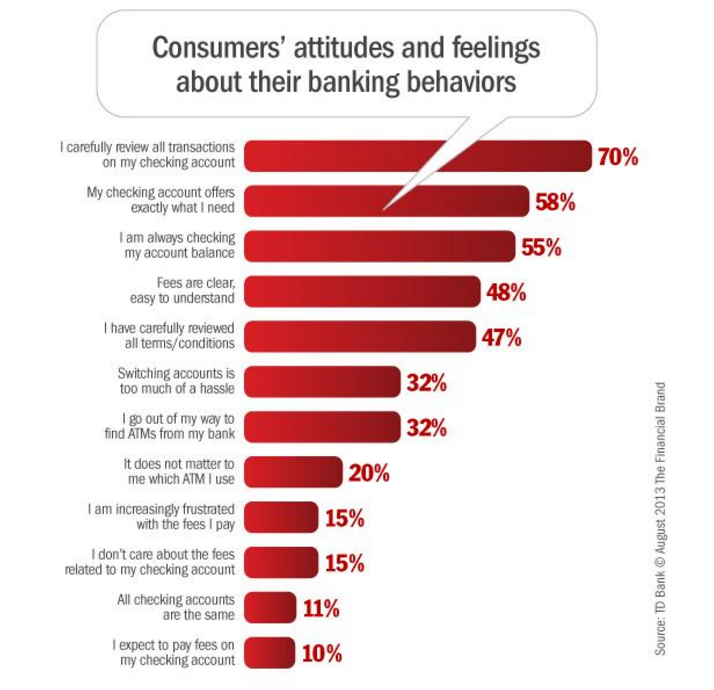

Checking accounts are one of the most basic banking products and yet one of the most important. A checking account essentially allows you to deposit funds in a bank account and spend it using checks, ATMs, online banking, auto debits and debit cards. Despite their simplicity, many consumers still have some lingering doubts about their checking accounts, as can be seen from the results of TD Bank Checking Experience survey below.

Source: TD Bank Checking Experience Index and The Financial Brand

More than half of the consumers surveyed didn’t understand the fee structure of their checking accounts and almost 90% were not happy with paying fees at all. And there is good reason for this - checking account overdraft fees are so high that if you do not pay attention you could end up paying the equivalent of a 2000% annual interest in certain situations!

Luckily, this can be easily avoided with some basic care. So, how do you ensure that you are using checking accounts to their maximum potential while avoiding things like overdraft fees which can burn a big hole in your pocket? Read on to find out.

Checking vs Savings accounts

A checking account is intended for your day to day transactions while a savings account, as the name suggests, is to save money gradually. Here is a table showing the basic differences.

| Feature | Checking Account | Savings Account | Comments |

|---|---|---|---|

| Government guarantee | $250,000.00 | $250,000.00 | This is the maximum amount in your account guaranteed by the federal government. As you can see, both accounts are equally secure in case the bank fails. |

| Purpose | Everyday use - bills, shopping, paychecks etc | Small savings | Saving accounts are good if you want to save for something that you plan to buy in the next 2-3 months. For longer periods, certificates of deposit or other investments might be better suited |

| Interest Rate | NIL | Usually around 0.1% which is quite low. However online banks offer much higher rates - the best ones are at around 1% | Online banks do not have the high costs associated with maintaining hundreds of physical branches and therefore offer a much better rate |

| Monthly fixed charge | Higher | Lower | Savings accounts have a much lower fixed monthly charge. Most banks will also waive this charge completely if you maintain a minimum balance in the account |

| Number of withdrawals allowed (deposits are unlimited) | Any number | Only 6 per month | This is the main reason why you have to use checking accounts at all. However, this only includes online and transactions through debit cards. In person withdrawals from banks or ATMs are not counted |

| Excessive withdrawal fee | NIL | Around $5 to $15 per withdrawal after the limit of 6 withdrawals | In case of too many withdrawals, banks may even change your savings account to checking automatically |

| Other fees and charges | There are usually more fees and charges for checking accounts and they are usually higher | Fees are generally lower compared to savings accounts | Things like Non-Network ATM Fee, Wire Transfer Fee, Online Transfer Fee, Balance Inquiry Fee etc |

| Minimum despot and minimum balance | Lower than saving accounts | Usually higher | This is the minimum amount required to open the account. Additionally, if you maintain the minimum balance specified, your monthly fixed charges may be waived off |

As can be seen from this comparison table, you should ideally have both a savings and a checking account. For best results, you should link both of these together. Get all your payments into your checking account, keep the amount you need for that month’s expenses there and transfer everything else to your savings account. You can even automate this process (like for example, transferring any balance greater than your average monthly expense of $1000 to your savings account).

Overdraft and Overdraft protection

This is an important enough feature of checking accounts to warrant a section of its own! An overdraft is the term used to describe a situation where you withdraw more money from your account than what is currently deposited. Essentially, it creates a situation of a negative balance in your account.

Overdraft is not an ideal situation to be in, since it is equivalent to borrowing a loan without even planning for it! What’s even worse is that the bank charges are very high if your account does go into overdraft. The per transaction fee for availing your overdraft facility is between $15 to $39 with most banks charging around $35. Keep in mind that this is per transaction. So if your account is hit with 4-5 debit transactions in a day when your balance is zero, you will be charged this fee 4-5 times! Some banks even charge a daily fee after this, for as long as your account remains in overdraft. Going into overdraft doesn’t necessarily lower your credit score, but it should still be avoided like the plague. The reason is that the bank charges for overdraft are, quite frankly, extortionate. Here are some tips to prevent your account from going into overdraft:

-

Check with your bank (this can usually be done through your online banking facility as well), on what types of transactions are allowed to cause an overdraft. Most banks allow overdraft for checks, bill payments and any automatic debits that you have set up. These cannot usually be turned off. However, you can usually decide on whether you want to allow overdrafts for ATM withdrawals, retail purchases and other one off online transactions. You should adjust these settings as per your preferences. Keep in mind that if you are hit with a transaction that you have disallowed for overdraft, you can be charged a not sufficient funds (or NSF) fee instead which is just as bad.

-

Overdraft protection is a feature which allows you to link your checking account with another checking account or your savings accounts or credit card. This way, if your checking account is about to go into overdraft, your bank will try and transfer money (automatically) from one of the linked accounts first. Only if there is no money (or available limit) in these linked accounts also, will your account go into overdraft. This is a good option to prevent overdraft but it costs about $5 to $12 per transaction as well, depending on the bank. Therefore, it is better than an overdraft but not by much.

Be mindful however, if you want to link your checking account to a credit card as the rates charged by your credit card are also high. A savings account link is generally the cheapest option.

- Get a line of credit from your bank. This will allow you to utilize this credit line in place of an overdraft. The interest rate for this facility might be somewhere around 18% per annum, charged on the overdraft amount. This might seem high but is exponentially better than what an overdraft costs which is generally much higher! Here is one example:

| Type | Amount | Charges (example) | Weekly cost |

|---|---|---|---|

| Overdraft | $1,000.00 | $30 per transaction | $30.00 |

| Line of credit | $1,000.00 | 18% per annum | $3.50 |

-

Set up automated text alerts for when your balance is running low or a payment is coming due. This way you can get a few days advance notice and can fund your account in time to avoid an overdraft.

-

The best way to avoid all the unnecessary costs associated with overdrafts is to manage your account actively. It is a good habit to download your statement every month and reconcile everything. This will not only give you a sense of what you are spending on but will also help you to spot any transactions that might be there by mistake. Once you get a general idea of how much you spend on each item every month you can plan accordingly and keep a sufficient balance in your account.

Choosing the right checking account

Many banks offer different categories of checking accounts. There are gold or premium accounts which offer benefits like no out of network ATM fees , free checkbooks, a safety deposit box and so on. This however comes at the cost of a higher monthly fee or a higher minimum balance requirement. Before you choose the right checking account, make sure you actually need all these features that you would be paying the extra money for. For most people, a basic account is sufficient.

You would also be served well by researching some online options. Online checking accounts offer a much better interest rate and lower fees than your local branch because their overheads are much lower. There are sacrifices like not being able to deposit cash or withdraw large amounts of cash (ATMs have limits on withdrawals) and there might even be small charges for using out of network ATMs as well. However, they make up for this in terms of lower fees and higher interest rates and the choice is totally dependent on how you plan to use your account. If you do select an online bank, make sure they have a user friendly app that you can use on your smartphone.

Some people have concerns regarding security of online accounts, but the fact is that even physical banks store their data online and are just as vulnerable as online banks. The safety aspect depends mostly on how well you protect yourself. The basic steps to protect your financial information for bank accounts is very similar to credit cards and you can learn more about these safety best practices here.

There is one last thing to consider. Visa and MasterCard usually offer their customers fraud protection on their credit cards. You should check with your bank if the same fraud protection and limited liability for fraudulent transactions is being offered on the debit card that comes bundled with your checking account.